Mobile Check Deposit

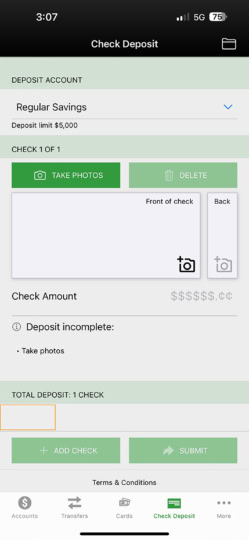

Use your smartphone and the ATFCU app to deposit checks when it’s most convenient. A program update in August 2024 now allows you to deposit more than one check at a time. The updated screen is shown below and, yes, there’s a lot going on here. We’ll take it step by step.

For Those New to Remote Check Deposit (RDC)

- Login to the ATFCU app.

- Tap on the Check Deposit icon at the bottom of the screen.

- Accept the Terms and Conditions.

- Within one business day, you will receive an email confirmation letting you know whether or not you have been approved for RDC. (This feature is available to those who have demonstrated responsible usage of their ATFCU checking account.)

- After the email is received, follow the steps below.

For All Users of Remote Check Deposit (RDC)

- Login to the ATFCU app and tap the Check Deposit icon at the bottom of the screen.

- On the new screen, tap the drop down menu to see a list of your accounts. Choose the one where you’d like the check deposited.

- Endorse the back of your check and neatly print ‘ATFCU MOBILE DEPOSIT’ below the endorsement.

- Follow the prompts to take pictures of the front and back of your check. Place your check on a flat, dark, uncluttered surface for the photos. Keep check images within the dotted guidelines shown in the app. The app will inform you if there is a problem with your photo and will prompt you to retake it.

- When the pictures are completed, type in the amount of the check you are depositing.

- If you have additional checks to deposit, tap the ‘ADD CHECK’ button and follow steps 6 – 8 above. Continue this process until you have deposited all of your checks.

- Tap the ‘SUBMIT’ button to complete the deposit.

- At this point your check is in review. Do not throw your check away or write VOID on it.

- Within a short period of time, you will receive an email stating the condition of your deposit and letting you know if there is a problem. Again, please do not do anything with the check until you receive a confirmation email stating that it has been accepted.

- Checks deposited and accepted prior to 5 pm on a business day will be deposited the same day.

- Checks deposited and accepted after 5 pm or on a weekend day will be deposited on the following business day.

These instructions sound more complicated in print than they actually are. We think you’ll quickly get the hang of it. If you would like some additional couching or have questions about the mobile deposit feature, please call our eServices Department (325-677-2274 or 800-677-6770) during regular business hours.