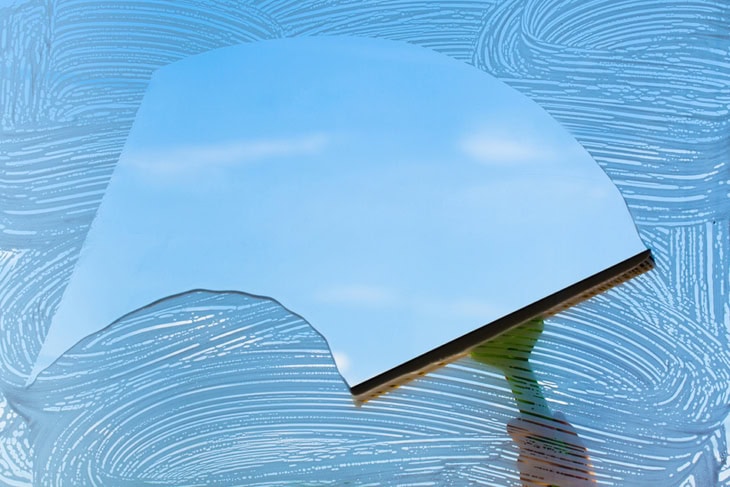

Our fees are low.

No need to hide.

|

Insufficient Funds (NSF) |

$25 each |

|

Overdraft Privilege Fee |

$25 each |

|

Stop Payment Fee |

$25 each |

|

Online Bill Payment NSF |

$25 each |

|

Online Bill Payment Stop Payment Fee |

$25 each |

|

Debit Card Replacement |

$5 occurrence |

|

Transaction Fee for ATM's not in CO-OP Network |

$1 occurrence |

|

Returned Deposited Check |

$15 each |

|

Temporary Checks |

$4 per page of 4 checks (12 free at account opening) |

|

Statement copies |

$2 per statement (recent statements free in online banking) |

|

Photocopy of Cancelled Checks |

$2 each after first two checks each month |

|

ReStart Checking Account |

$5 month |

|

Check Printing Cost |

varies by design |

|

Domestic Wire Fee |

$15 each (any amount) |

|

International Wire Fee |

$40 each (any amount) |

|

Account Research & Balancing |

$20 per hour |

|

Lien/Levy/Garnishment |

$25 per item |

|

Uncollected Funds Fee |

$25 per item |

|

Manual Check Clearing Fee |

$1 per check |

|

Digital Transfer to External Bank/Credit Union |

$4.00 per transaction |

|

Notary Service |

Free to members |

|

Money Orders |

$1 each |

|

Cashier's Check |

$2 each |

|

Check by Phone |

$5 each |

|

Gift Cards |

$2 each |

|

Reloadable Debit Cards |

$6 each |

|

Digital Banking Loan Pay with External Debit Card |

$4 each |

|

Digital Banking Loan Pay with External Bank Account |

No Charge |

|

Late Payment, Home Equity & Home Improvement Loans originated prior to 10-1-2015 |

After 15 days late, 1% of past due principal and interest |

|

Late Payment Fee, Home Equity & Home Improvement Loans originated after 10-1-2015 |

After 15 days late, 4% of past due principal and interest |

|

Late Payment Fee, First Mortgage Loan, |

After 15 days late, 5% of past due principal and interest |

|

Late Payment Fee, First Mortgage Loan, |

After 15 days late, 4% of the past due principal and interest |

|

Late Payment Fee, Consumer Loans originated prior to 1-1-2016 |

After 15 days late, 20% of the interest due. Minimum - $5; Maximum - $17 |

|

Late Payment Fee, Consumer Loans originated after 1-1-2016 |

After 15 days late, 5% of the payment amount. Minimum - $10 |

|

Late Payment Fee, Credit Cards |

After 15 days late, $17 per event |

|

Account closed within 90 days of opening |

$15 per event |

|

Incorrect Mailing Address |

$5 per month |

|

Non-ATFCU card used at an ATFCU ATM |

$3 each |

|

Use of Copy Machine |

$1 per page |

|

Use of Fax Machine |

$3 for first page/$1 for other pages |

Effective May 1, 2021 (yes, that’s right. No changes in more than 4 years.)

Contact us with additional questions.

(325) 677-2274 -call or text

(800) 677-6770 – calls only